The average price of a home in South Africa – Cape Town, Joburg, and more

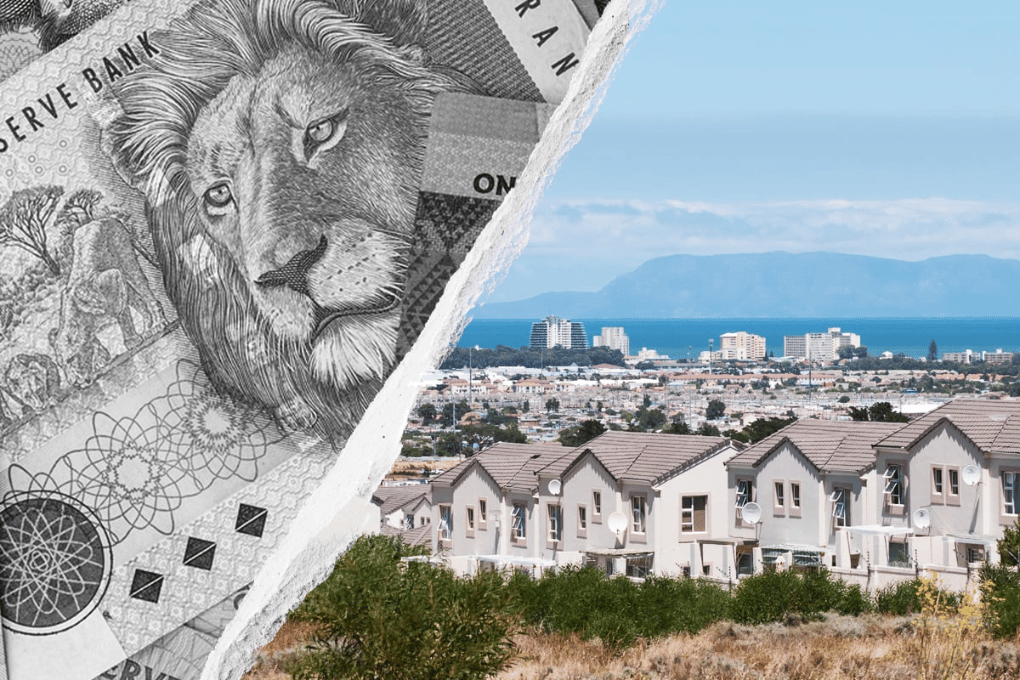

The South African property market is showing renewed optimism following a recent interest rate cut by the South African Reserve Bank (SARB). With the average home price in the country at around R1.135 million, the rate cut is expected to ease financial pressure on existing homeowners and attract new buyers. Samuel Seeff, chairman of the Seeff Property Group, believes this is a pivotal moment for the market, particularly after a period of high interest rates that stifled economic and property sector growth.

The high borrowing costs had led to a nearly 40% drop in transaction volumes, and many homeowners had to absorb bond repayment increases of up to R3,000 per month. Seeff has long advocated for interest rate cuts, pointing out that the strengthening rand, record-high Johannesburg Stock Exchange (JSE) figures, and nearly six months of stable electricity supply are signs that the economy is in a better position.

The rate cut offers potential homebuyers lower borrowing costs, with the average monthly repayment on a 20-year loan at 11.50% standing at roughly R12,104. However, the affordability varies across provinces, with the Western Cape’s high average home price of R1.65 million making it less favourable compared to more affordable regions like the Free State and North West.

Experts anticipate further rate cuts in the near future, which could help stimulate the stagnant market and reverse the value erosion seen in recent years, particularly in areas like Cape Town.