SARB cuts interest rate: is it too late for South African households?

The South African Reserve Bank (SARB) announced a 25-basis-point cut in the repo rate, reducing it to 7.75%, with the prime lending rate now at 11.25%. This follows a similar cut in September, marking the start of a slow interest rate reduction cycle after years of increases. While the cut provides some relief, many, including industry leaders, argue it is too small to significantly alleviate economic pressures on households.

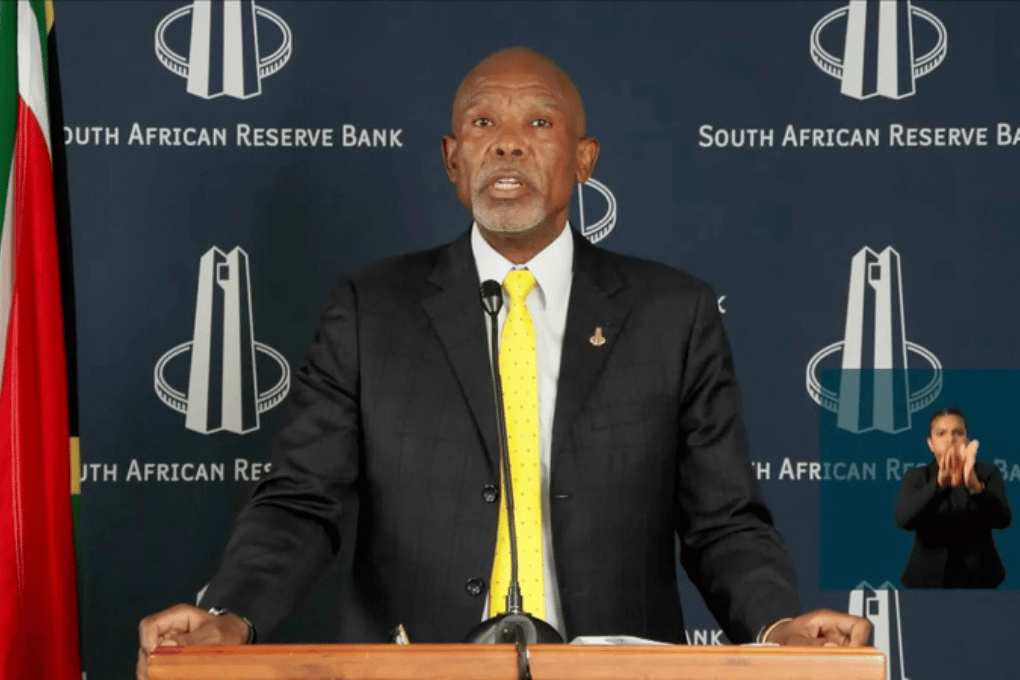

Annual consumer inflation fell to 2.8% in October, the lowest since June 2020, driven by fuel and food price declines. SARB Governor Lesetja Kganyago cited easing inflation and a stronger rand as factors influencing the decision. However, Neil Roets, CEO of Debt Rescue, highlighted that the reduction offers minimal help to struggling households, which are still burdened by record-high interest rates, escalating living costs, and food insecurity worsened by seasonal droughts. Roets warns of an increasing reliance on short-term loans, trapping many in debt cycles, and urges consumers to seek debt counselling.

In the property market, Antonie Goosen of Meridian Realty sees the cut as a positive for both buyers and sellers. For homeowners, it reduces monthly bond repayments—saving around R150 on a R1 million bond. It also makes homeownership more accessible, potentially stimulating market activity in 2025.

While the rate cut provides hope, experts caution that global economic challenges, including restrictive monetary policies abroad, may limit future rate reductions. South Africans are advised to focus on financial resilience amidst ongoing uncertainty.