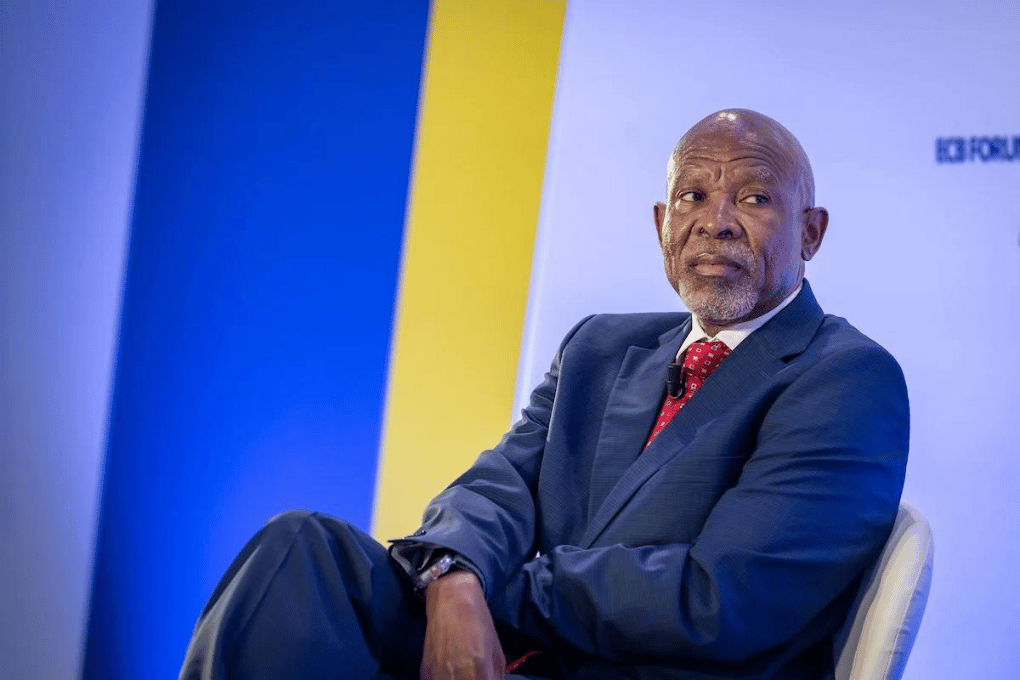

South African Reserve Bank Governor Lesetja Kganyago has emphasised a cautious approach to adjusting interest rates to avoid policy missteps. Speaking to CNBC Africa, he stressed the importance of not reacting impulsively to past data. “You do not make policy on the past. You make policy on the future,” he explained, highlighting the challenges posed by uncertain global economic conditions.

The Reserve Bank cut its key interest rate by 25 basis points in November 2024, lowering it to 7.75%. This marked the second reduction since the Monetary Policy Committee (MPC) began its easing cycle in September. However, some analysts had called for a larger cut after annual inflation fell to 2.8% in October, the lowest in years. Kganyago noted that monetary policy remains restrictive, with the policy benchmark still 4.95 percentage points above inflation.

November inflation is expected to edge higher to 3.1% due to rising gasoline prices and a depreciating rand, which has weakened by 3% against the dollar since Donald Trump’s US election win. Concerns about global policy shifts, particularly around US tariffs and tax cuts, could exacerbate domestic price pressures by keeping the dollar strong and raising import costs.

Kganyago also reiterated his support for lowering South Africa’s inflation target, currently set at 3% to 6%. He noted that this range is high compared to peers, with emerging markets typically targeting around 3%. He argued that a lower inflation target would enhance South Africa’s competitiveness and contribute to price stability.