Home loan crackdown in South Africa

BusinessTech:

South Africa plans to amend the Home Loan and Mortgage Disclosure Act to require banks to disclose more information on mortgage lending, aiming to improve access to home loans for previously disadvantaged citizens. The changes will allow state investigation of consumer complaints and increase penalties for non-compliant lenders.

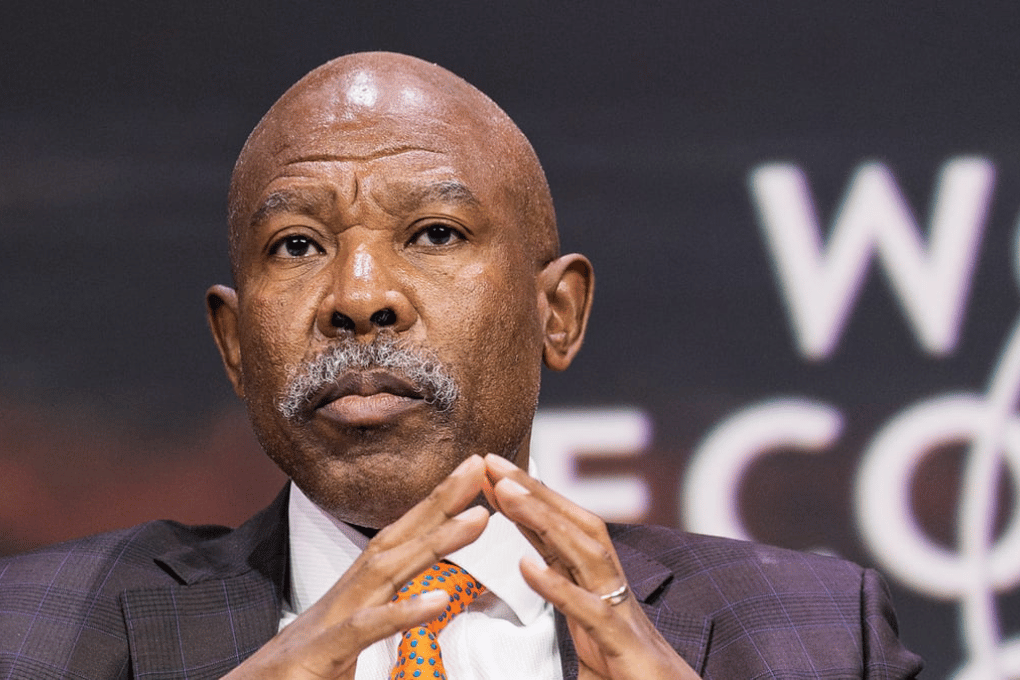

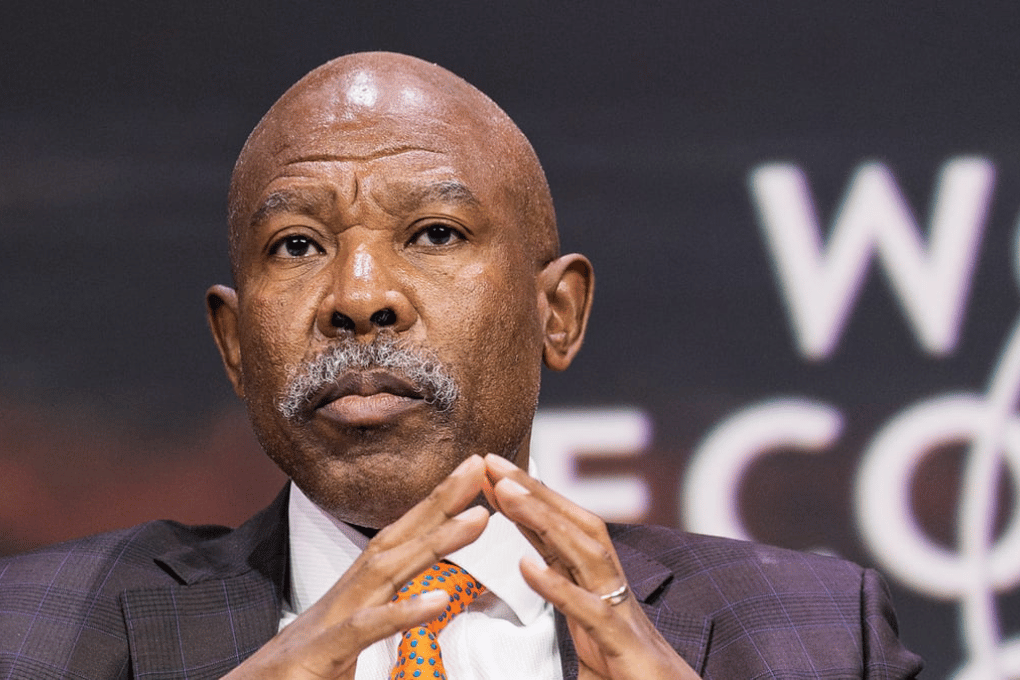

No interest rate relief for South Africans this year

Daily Investor:

Investors are now betting that South Africa’s central bank might raise interest rates next month, influenced by unexpected inflation dynamics in the U.S. and heightened inflation expectations locally, leading to a reconsideration of previous bets on rate cuts.

Where South Africans are cutting spending – Nedbank

NewsHub

Nedbank’s analysis shows a 3% drop in personal incomes among its clients in 2023, contrasting with BankservAfrica’s data indicating a salary increase across formal employment. High interest rates have escalated loan repayments, forcing South Africans to reduce spending on essentials and non-essentials alike, impacting various consumer sectors.

Interest rate cuts in South Africa face another hurdle

BusinessTech:

Investec and Standard Bank economists suggest differing timelines for South Africa’s interest rate cuts, influenced by US Federal Reserve actions and market volatility. While some predict cuts starting mid-2024, others foresee delays until 2025 or post-US elections, impacting commodity prices and the rand amidst ongoing inflation concerns.