Warning for interest rates in South Africa

BusinessTech:

The reelection of Donald Trump and potential US tariffs on BRICS countries could affect South Africa’s economic outlook. Despite inflation at a four-year low of 2.8%, rising US interest rates and currency pressures threaten further cuts to South Africa’s repo rate, currently at 7.75%, while fears over a BRICS currency remain unfounded.

Bad news about inflation and interest rates in South Africa

Daily Investor:

South African inflation dipped below 3% in October but is expected to rebound due to rising electricity tariffs and medical aid costs. Goods inflation, now 1.4%, drove the recent decline, but service inflation remains steady. The Reserve Bank forecasts inflation to average 4% in 2024, with cautious interest rate cuts.

South African consumers remain confident in the property market outlook – ABSA

ABSA:

The Absa Homeowner Sentiment Index (HSI) shows 84% of South Africans remain optimistic about the residential property market, buoyed by two interest rate cuts. First-time buyers drive growth, with buy-vs-rent confidence at 83%. Cautious optimism prevails as house prices show incremental improvement, and inland regions exhibit higher confidence than coastal areas.

South Africans losing their homes

Daily Investor:

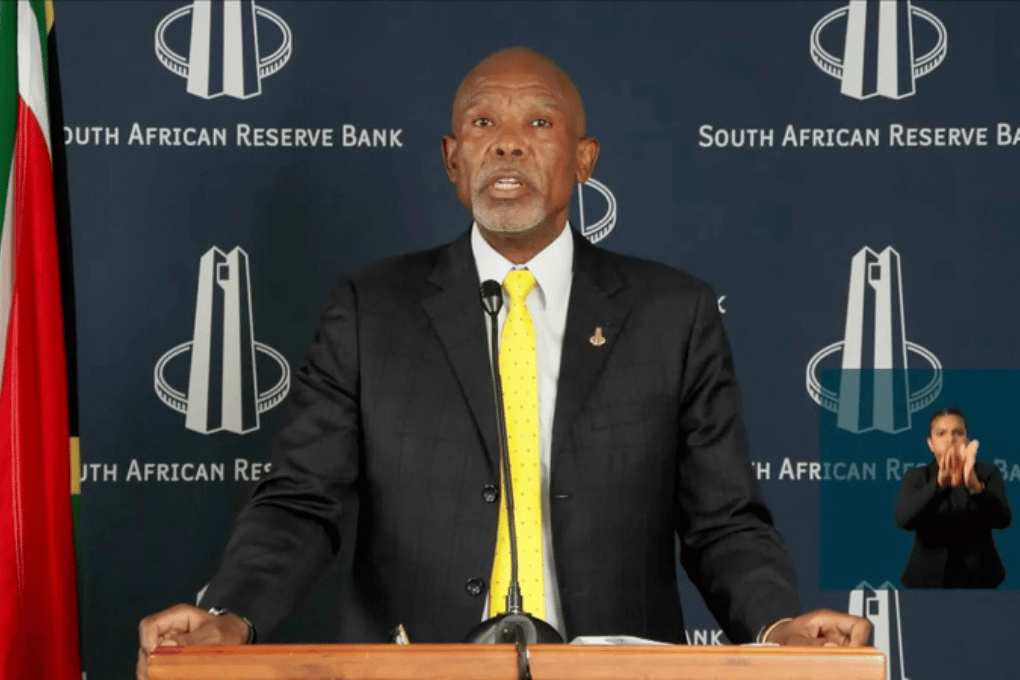

The SARB’s cautious interest rate cuts exacerbate economic hardship, with home loan defaults rising to 12.2%, up from 7-8%. Sentinel Homes’ Renier Kriek criticises the Reserve Bank for prioritising inflation targeting despite inflation being below pre-pandemic levels, arguing that more aggressive cuts could relieve financial pressure, stimulate growth, and create jobs.

SARB cuts interest rate: is it too late for South African households?

IOL:

The SARB’s second interest rate cut of 2024 reduces the repo rate to 7.75%, offering minor relief for South Africans facing economic hardships. While beneficial for homeowners and prospective buyers, critics argue the modest 25-basis-point cut is insufficient to address the high cost of living, rising debt, and food insecurity.

Distressing emerging trend for homeowners in South Africa

BusinessTech:

Financial distress is forcing nearly a quarter of South African homeowners to sell their properties, with 23% citing financial pressure in Q3 2024. Mortgage arrears have risen to 7.8%, far exceeding historical averages. Escalating living costs, soaring utility tariffs, and stagnant wages are compounding the strain, challenging homeowners’ financial stability.

RMB launches South Africa’s first ZARONIA calculator

IOL:

The Johannesburg Interbank Average Rate (JIBAR) will be replaced by the ZARONIA benchmark rate in South Africa. This shift impacts JIBAR-linked transactions, including loans, deposits, and derivatives. RMB has launched a ZARONIA Calculator and advisory services to assist businesses in adapting to the new reference rate and mitigating potential disruptions.

Alarming trend emerging for landlords in South Africa

BusinessTech:

South Africa’s rental market in 2024 faces rising squatter rates, climbing to 3.71% in Q2, despite historically low vacancy rates averaging 5.57%. Squatters disrupt cash flow, leaving landlords vulnerable. While tenant payment behaviours have slightly improved, challenges persist, especially among lower-income tenants. Effective management and legal compliance are critical for stability.

Top trends for property buyers and investors to look out for in 2025

BusinessTech:

South Africa’s 2025 real estate market is expected to focus on affordability, sustainability, and innovation. Key trends include efficient urban living, technological adoption, sustainable investments, luxury properties, and economic diversification. Demand spans mid-tier to premium housing, driven by young professionals and international investors seeking returns in an evolving, resilient market.

Big shift coming for South African property in 2025

Daily Investor:

Rental prices in South Africa are set to rise as landlords adjust to higher homeownership costs, tightening rental markets, and low vacancy rates. Subdued housing inflation, averaging 2.7%–3.1% recently, faces upside risks. With falling interest rates making homeownership more attractive, the rent-or-buy debate may shift towards purchasing.