Bigger interest rate cuts on the cards

Daily Investor:

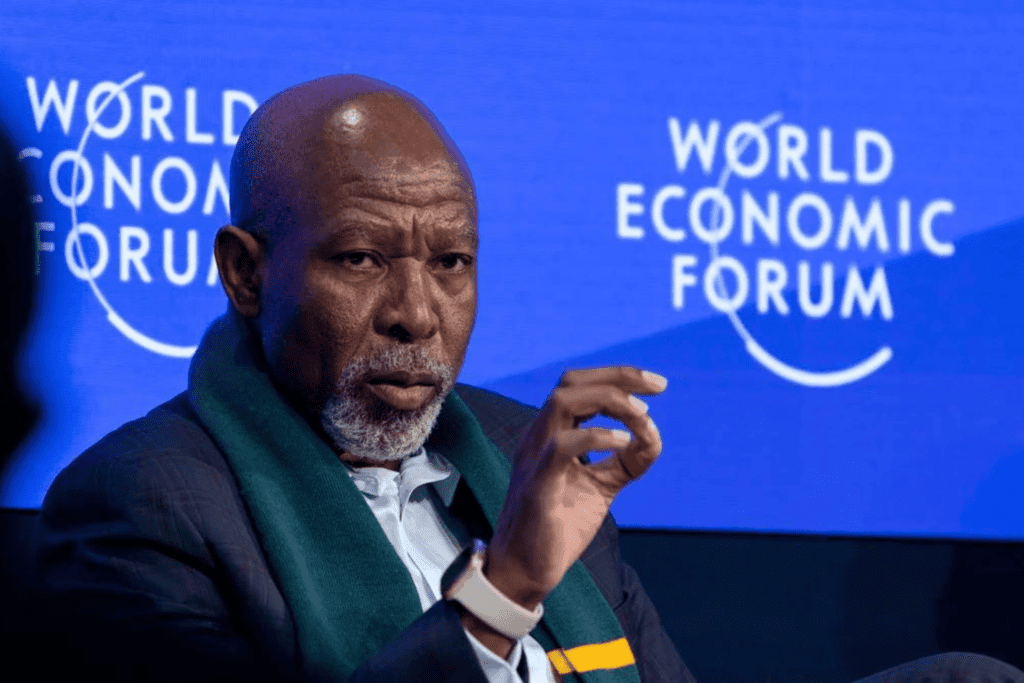

South Africa’s inflation expectations dropped to 4.6%, nearing the 4.5% midpoint preferred by the central bank, supporting continued interest-rate cuts. November inflation rose to 2.9% due to subdued food-price growth. Governor Lesetja Kganyago stressed caution on rate adjustments amid global uncertainties, with a 25 basis-point cut likely on 30 January.

South African inflation expectations decline to three-year low

Moneyweb:

South Africa’s inflation expectations for the next two years dropped to 4.6%, nearing the central bank’s preferred 4.5% midpoint, supporting gradual interest-rate cuts. Inflation edged to 2.9% in November, with eased food-price growth. Governor Lesetja Kganyago signalled cautious monetary adjustments amidst global uncertainties, including US trade policy and domestic economic pressures.

The top homeownership trends in 2024 – according to Absa

Property Professional:

Absa’s Homeowners Sentiment Index for 2024 highlights trends including strong solo female ownership (66.6%) and rising first-time buyers (48%). Rental property conversions and alternative energy adoption are growing, while reducing electricity costs remains key. Consumer confidence is stable at 84%, driven by long-term property value belief despite economic and political concerns.

The most expensive provinces for rent in South Africa

BusinessTech:

The Western Cape leads South Africa’s rental market with an average rent of R10,875 and 9.3% annual growth, while national rental growth reached 4.8% in Q3 2024. Improving tenant affordability, falling inflation, and interest rate cuts signal a more stable rental market, with tenants spending under 30% of income on rent.

8 signs you should skip buying a property in SA

BusinessTech:

The South African Reserve Bank’s November 2024 repo rate cut to 7.75% and the prime lending rate to 11.25% is spurring cautious optimism in the property market. However, experts warn buyers to prioritise due diligence by addressing red flags like structural issues, location drawbacks, outdated systems, and overpricing to ensure sound investments.

Red flags for people with home loans in South Africa

BusinessTech:

South African households face mounting financial distress, with mortgage defaults climbing as non-performing loans rose to R304 billion by mid-2024. Debt-servicing costs now consume 9% of disposable income. Nearly 23% of home sales are driven by financial difficulties, highlighting the cost-of-living crisis exacerbated by inflation and rising interest rates.

Bad news for South Africans who own a house

Daily Investor:

Residential mortgage defaults in South Africa have risen sharply, now above 6% of all home loans, nearly double the historical average. Elevated interest rates have pushed household debt-servicing costs to 9% of disposable income. Many households are struggling with rising costs, turning to credit cards, personal loans, or skipping essential payments.

Record-high house prices on the cards

Cape Business News:

South Africa’s residential property market shows robust recovery, with house prices now 39% higher than in 2019. First-time buyer applications rose 30% year-on-year, and Western Cape prices increased by 7.7%. Despite lingering effects of high interest rates, easing inflation and anticipated rate cuts are boosting confidence, spurring further market growth.

Warning for interest rates in South Africa

BusinessTech:

The reelection of Donald Trump and potential US tariffs on BRICS countries could affect South Africa’s economic outlook. Despite inflation at a four-year low of 2.8%, rising US interest rates and currency pressures threaten further cuts to South Africa’s repo rate, currently at 7.75%, while fears over a BRICS currency remain unfounded.

South African consumers remain confident in the property market outlook – ABSA

ABSA:

The Absa Homeowner Sentiment Index (HSI) shows 84% of South Africans remain optimistic about the residential property market, buoyed by two interest rate cuts. First-time buyers drive growth, with buy-vs-rent confidence at 83%. Cautious optimism prevails as house prices show incremental improvement, and inland regions exhibit higher confidence than coastal areas.