Bad news about inflation and interest rates in South Africa

South African inflation fell below the Reserve Bank’s 3%-6% target range in October, a first since 2021, when global disruptions caused prices to plummet. However, this sub-3% inflation rate is expected to be temporary as rising electricity tariffs and medical aid costs are likely to push prices higher. Goods inflation, particularly lower food and fuel prices, drove the current decline, reaching 1.4% year-on-year in October. In contrast, service inflation, linked to domestic demand, declined more gradually, falling to 4.3%.

The Reserve Bank’s Monetary Policy Committee (MPC) recently reduced the repo rate from 8% to 7.75%. The Bank forecasts inflation to average 4% in 2024 and stabilise around 4.5% by 2026-2027, with GDP growth reaching 2% by 2027. Risks to these forecasts remain balanced, with global uncertainty and local administered price increases posing challenges.

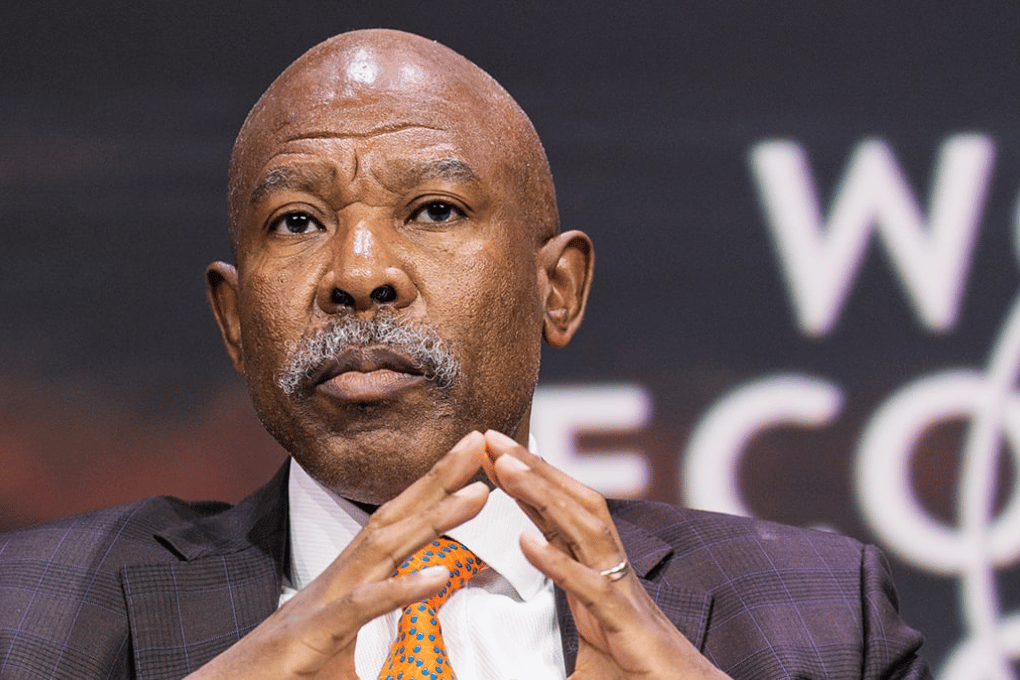

Governor Lesetja Kganyago emphasised external factors like US monetary policy and domestic risks, particularly the rand’s sensitivity to global conditions. A stronger dollar, driven by slower-than-expected US interest rate cuts, could weaken the rand and increase inflation locally.

Market expectations for global interest rate cuts have been scaled back, with the US Federal Reserve now cautiously forecasting a fed funds rate of 3.8% by the end of 2025. This has implications for South Africa, where the Reserve Bank remains wary of cutting rates too aggressively, prioritising stability amidst heightened global and local uncertainties.